In today’s digital age, our smartphones and tablets are essential to daily life, making it crucial to protect them against damage or loss.

With the increasing reliance on mobile devices, having reliable insurance coverage is more important than ever. That’s where comprehensive coverage comes in, offering flexible plans to fit various needs.

Optimum Mobile Insurance provides peace of mind, ensuring that users can stay connected without worrying about the financial implications of device damage or loss.

Key Takeaways

- Comprehensive coverage for mobile devices

- Flexible plans to fit various needs

- Protection against device damage or loss

- Peace of mind with reliable insurance coverage

- Importance of protecting essential devices

What is Optimum Mobile Insurance?

Optimum Mobile Insurance is designed to provide comprehensive coverage for your mobile device against various risks. This insurance service is tailored to protect your device against accidental damage, theft, and loss, ensuring that you can quickly recover or receive compensation.

Understanding the Basics of Mobile Insurance

Mobile insurance is a type of coverage that helps protect your device and, in some cases, your personal data. The basics of mobile insurance involve understanding what is covered and how to file a claim. Optimum Mobile Insurance offers reliable mobile insurance services that cater to different needs.

Typically, mobile insurance plans cover:

- Accidental damage, such as drops or spills

- Theft or loss of the device

- Malfunction or mechanical breakdown

The Importance of Protecting Your Device

Protecting your mobile device is crucial in today’s digital age. Your device likely contains sensitive personal data, important contacts, and possibly business information. Losing this data can be catastrophic without the right protection.

To illustrate the importance of mobile device protection, consider the following comparison:

| Risk | Without Insurance | With Optimum Mobile Insurance |

|---|---|---|

| Accidental Damage | High cost for repair or replacement | Minimal deductible for repair or replacement |

| Theft or Loss | Loss of device and personal data | Quick replacement or compensation |

By choosing Optimum Mobile Insurance, you can ensure that your device is protected against various risks, providing you with peace of mind and financial security.

Key Features of Optimum Mobile Insurance

With Optimum Mobile Insurance, you get more than just basic coverage; you get a suite of features tailored to your needs. This comprehensive insurance plan is designed to protect your mobile device against various risks, ensuring you’re always connected.

Coverage Options Available

Optimum Mobile Insurance offers a variety of coverage options to suit different needs. Whether you’re looking for protection against accidental damage, theft, or mechanical failure, there’s a plan that’s right for you. By comparing mobile insurance options, you can identify the best coverage for your lifestyle.

The available coverage options include:

- Accidental damage coverage

- Theft and loss protection

- Mechanical and electrical breakdown cover

- Liquid damage protection

Device Protection Plans Explained

Understanding the device protection plans offered by Optimum Mobile Insurance is crucial. These plans are designed to be flexible, allowing you to choose the level of protection that suits your device’s value and your personal circumstances.

Each plan includes:

- A clear claims process

- Quick repair or replacement options

- Dedicated customer support

Additional Benefits of Choosing Optimum

Choosing Optimum Mobile Insurance comes with several additional benefits. Not only do you get comprehensive coverage, but you also enjoy peace of mind knowing your device is protected. Optimum stands out as one of the best mobile insurance plans available, offering reliability and flexibility.

Some of the key benefits include:

- 24/7 customer support

- Quick claim processing

- Flexible payment plans

By opting for Optimum Mobile Insurance, you’re not just protecting your device; you’re investing in a service that understands your needs and provides tailored solutions.

How Optimum Mobile Insurance Works

Understanding how Optimum Mobile Insurance works is crucial for making informed decisions about your mobile device’s protection. Optimum Mobile Insurance is designed to provide comprehensive coverage, ensuring that you’re protected against various risks such as damage, loss, or theft.

Claim Process Simplified

The claim process with Optimum Mobile Insurance is designed to be straightforward and efficient. When you experience damage, loss, or theft, you can file a claim through their user-friendly online portal or by contacting their customer service directly. This simplicity ensures that you can quickly recover from any unforeseen events.

For instance, if your device is damaged, you’ll need to provide details about the incident and possibly submit some documentation. Optimum Mobile Insurance’s team will then guide you through the next steps, making the process as hassle-free as possible.

What To Do When Your Device Is Damaged

If your device is damaged, the first step is to assess the extent of the damage. If it’s repairable, Optimum Mobile Insurance will guide you on the best course of action. In cases where the device is beyond repair, they will assist you in getting a replacement, ensuring minimal disruption to your mobile life.

It’s essential to notify Optimum Mobile Insurance as soon as possible after the incident to initiate the claim process. Their dedicated team is available to support you through every step, ensuring that you’re back up and running quickly.

Understanding Deductibles and Fees

Deductibles and fees are crucial components of your insurance plan. Understanding these elements is key to managing your expectations and costs. Optimum Mobile Insurance provides clear information about deductibles and any applicable fees, ensuring transparency and helping you make informed decisions about your coverage.

| Deductible Type | Description | Cost |

|---|---|---|

| Standard Deductible | Applies to most claims | $50 |

| Premium Deductible | For comprehensive coverage | $25 |

By understanding how deductibles work and what fees are associated with your plan, you can better navigate the insurance landscape and choose the coverage that best suits your needs.

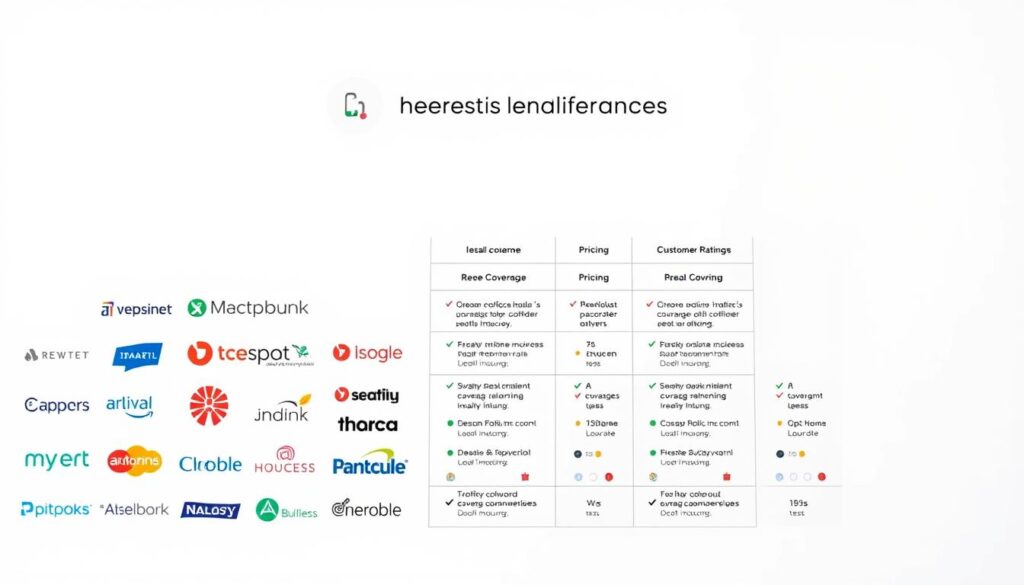

Comparing Optimum Mobile Insurance to Competitors

In a sea of mobile insurance options, Optimum Mobile Insurance is a top contender. With numerous providers offering a range of services, it’s crucial to compare their features and benefits to make an informed decision.

How It Stacks Up Against Other Brands

Optimum Mobile Insurance is distinguished by its comprehensive coverage options and customer-centric approach. When compared to other top mobile insurance providers, Optimum stands out due to its flexible plans and extensive protection features.

A detailed comparison with other leading brands reveals that Optimum Mobile Insurance offers more personalized coverage, allowing users to tailor their insurance plans according to their specific needs.

Unique Selling Points of Optimum

One of the key advantages of Optimum Mobile Insurance is its quick claim process. Unlike some competitors, Optimum ensures that claims are processed efficiently, minimizing downtime for users.

Additionally, Optimum’s 24/7 customer support provides policyholders with assistance whenever they need it, setting it apart from other providers that may offer limited support hours.

Customer Satisfaction Ratings

Customer satisfaction is a critical metric for evaluating insurance providers. Optimum Mobile Insurance boasts high customer satisfaction ratings, thanks to its reliable service and comprehensive coverage.

Reviews and testimonials from existing customers highlight the ease of use and effectiveness of Optimum’s insurance plans, further solidifying its position among the top mobile insurance providers.

Who Should Consider Optimum Mobile Insurance?

Mobile device users who need protection against accidental damage or theft should consider Optimum Mobile Insurance. With the increasing reliance on smartphones for daily activities, having a reliable mobile insurance service can be a lifesaver.

Ideal Customers for Mobile Insurance

Optimum Mobile Insurance is ideal for individuals who:

- Use their mobile devices for critical tasks such as business or education.

- Cannot afford to replace their devices frequently.

- Store sensitive information on their devices.

- Are prone to accidents or live in areas with high theft rates.

These individuals will benefit from mobile device protection plans that cover repairs or replacements, ensuring minimal disruption to their daily lives.

Scenarios Where Insurance is Essential

There are several scenarios where having Optimum Mobile Insurance is crucial:

- Accidental Damage: Dropping your device or causing unintended damage.

- Theft or Loss: Having your device stolen or lost.

- Liquid Damage: Accidental exposure to water or other liquids.

- Mechanical Failure: Device malfunction due to manufacturing defects or wear and tear.

By understanding these scenarios, potential customers can make informed decisions about their need for reliable mobile insurance services.

In conclusion, Optimum Mobile Insurance is designed to provide comprehensive coverage for mobile device users who need protection against various risks. By choosing the right mobile device protection plan, individuals can safeguard their devices and ensure continuity in their personal and professional lives.

Frequently Asked Questions About Optimum Mobile Insurance

Navigating the world of mobile insurance requires answers to your most pressing questions. Optimum Mobile Insurance is designed to provide comprehensive coverage, but understanding its specifics is key to making informed decisions.

Common Queries Answered

Many users wonder about the scope of Optimum Mobile Insurance. It covers a wide range of incidents, including accidental damage, theft, and mechanical breakdown. When comparing mobile insurance options, it’s essential to consider what each plan covers and how it aligns with your needs.

Some of the most common questions include:

- What does the insurance cover?

- How do I file a claim?

- Is there a deductible?

Clarifications on Coverage Limits

Understanding the coverage limits of your mobile insurance plan is crucial. Optimum Mobile Insurance offers flexible plans that can be tailored to your device’s value and your personal requirements. When evaluating the best mobile insurance plans, consider the maximum payout in case of a claim and any conditions that may affect your coverage.

What’s Not Covered?

While Optimum Mobile Insurance provides extensive protection, there are certain exclusions to be aware of. These may include damage caused by misuse, software issues, or pre-existing conditions. It’s vital to read the policy details carefully to understand what’s not covered and how to avoid potential pitfalls.

By addressing these FAQs, we hope to provide clarity on Optimum Mobile Insurance and help you make an informed decision when comparing different mobile insurance options.

Tips for Choosing the Right Insurance Plan

With numerous insurance options available, choosing the right plan requires careful consideration. The process involves evaluating your personal needs, understanding the intricacies of policy exclusions, and making an informed decision based on the information available.

Assessing Your Personal Needs

To select the most appropriate insurance plan, it’s crucial to first assess your personal needs. Consider the value of your device, your usage patterns, and your financial situation. For instance, if you frequently travel or use your device in hazardous environments, you may require a more comprehensive coverage plan.

- Evaluate the cost of the device and the potential cost of repairs or replacement.

- Consider your lifestyle and how it impacts your device’s vulnerability to damage or loss.

- Assess your budget to determine a comfortable premium payment.

Understanding Policy Exclusions

Policy exclusions are conditions or situations that are not covered by the insurance plan. Understanding these exclusions is vital to avoid unexpected surprises when filing a claim. Common exclusions may include damage caused by water, loss due to theft if not reported within a certain timeframe, or damage resulting from pre-existing conditions.

Key aspects to review in policy exclusions include:

- The specific conditions under which a claim can be made.

- Any deductibles or fees associated with filing a claim.

- The process for handling claims and the typical timeframe for resolution.

Making an Informed Decision

Making an informed decision involves comparing different insurance plans, understanding the coverage provided, and evaluating the reputation of the insurance provider. It’s also beneficial to read reviews and seek recommendations from existing customers.

When comparing plans, consider the following:

- The level of coverage offered and the associated premiums.

- The reputation and customer service quality of the insurance provider.

- Any additional benefits or services included with the plan, such as affordable mobile insurance coverage options.

By carefully assessing your needs, understanding policy exclusions, and comparing available options, you can select a plan from top mobile insurance providers that offers the right balance of coverage and affordability.

Ultimately, the goal is to find a plan that provides peace of mind and financial protection against unforeseen events. By following these tips, you can navigate the complex landscape of mobile insurance and make a decision that aligns with your personal and financial circumstances.

Customer Testimonials and Success Stories

Optimum Mobile Insurance has been a game-changer for many of its customers, providing peace of mind and financial protection against unforeseen damages or losses. By offering reliable mobile insurance services, Optimum has built a reputation for being a trusted partner in safeguarding mobile devices.

Reliable Support in Times of Need

Customers have praised Optimum for its efficient claim process and comprehensive coverage options. One customer shared their experience of getting a quick replacement for their damaged phone, appreciating the hassle-free service. Such testimonials underscore the value of obtaining mobile phone insurance quotes from Optimum.

A Commitment to Continuous Improvement

The feedback gathered from customers is used to continually improve Optimum’s services. By listening to their clients, Optimum ensures that its mobile insurance plans remain relevant and effective, addressing the evolving needs of its users.

For those considering mobile insurance, the experiences of existing customers can provide valuable insights. Optimum Mobile Insurance stands out for its commitment to delivering reliable mobile insurance services, making it a preferred choice for many.